Proof-of-Work and Proof-of-Stake difference

If you're new to the cryptocurrency world, you've probably heard of both proof-of-work (PoW) and proof-of-stake (PoS). These two concepts are key to cryptocurrency transactions and security. More precisely, there are two different methods for validating cryptocurrency transactions.

If you're new to the cryptocurrency world, you've probably heard of both proof-of-work (PoW) and proof-of-stake (PoS). These two concepts are key to cryptocurrency transactions and security, more specifically – they are two different methods for validating cryptocurrency transactions.

PoW and PoS are known as consensus mechanisms. Both, in different ways, help ensure that users are honest in their transactions, thereby reducing fraud such as double spending.

PoW means that the verification of cryptocurrency transactions is done through mining. With PoS, validators are chosen based on a set of rules depending on the “stake” they have in the blockchain. This means that they commit to locking a certain token in order to have a chance to be chosen as a validator. In any case, cryptocurrencies are designed to be decentralized and distributed, meaning that transactions are visible and verified by computers around the world.

Computers on the network must agree on what happened in order to confirm transactions. If a computer tries to manipulate or commit fraudulent transactions on the network, it will be known through the public, immutable nature of the blockchain. Both consensus mechanisms have economic consequences that punish malicious actors who attempt to disrupt the network.

Proof-of-work vs. Proof-of-stake: Which is better?

PoW involves a competition between miners to solve cryptographic puzzles and confirm transactions to earn token rewards. PoS implements randomly selected validators to ensure that the transaction is reliable, also compensating them in return with crypto. Both methods have unique advantages and disadvantages.

The downsides of PoW

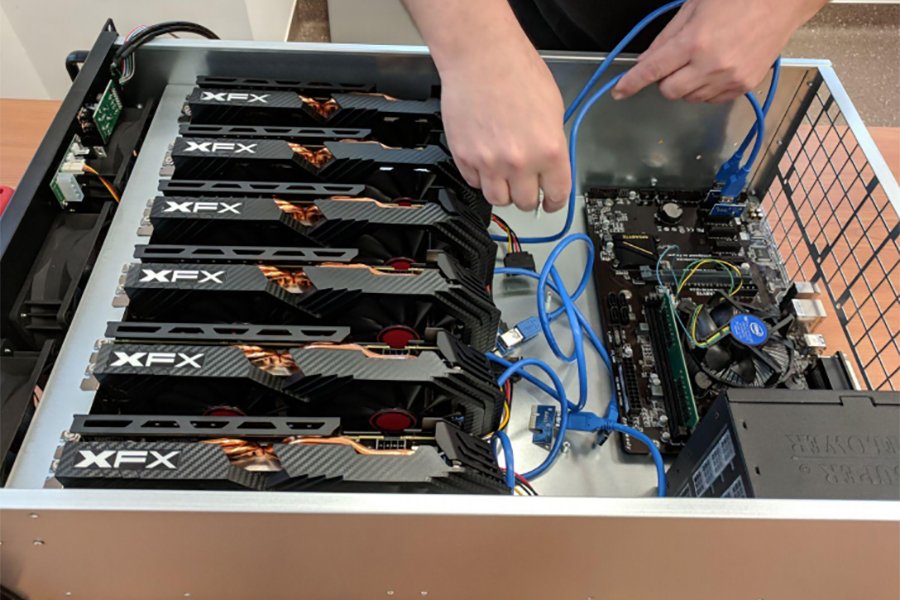

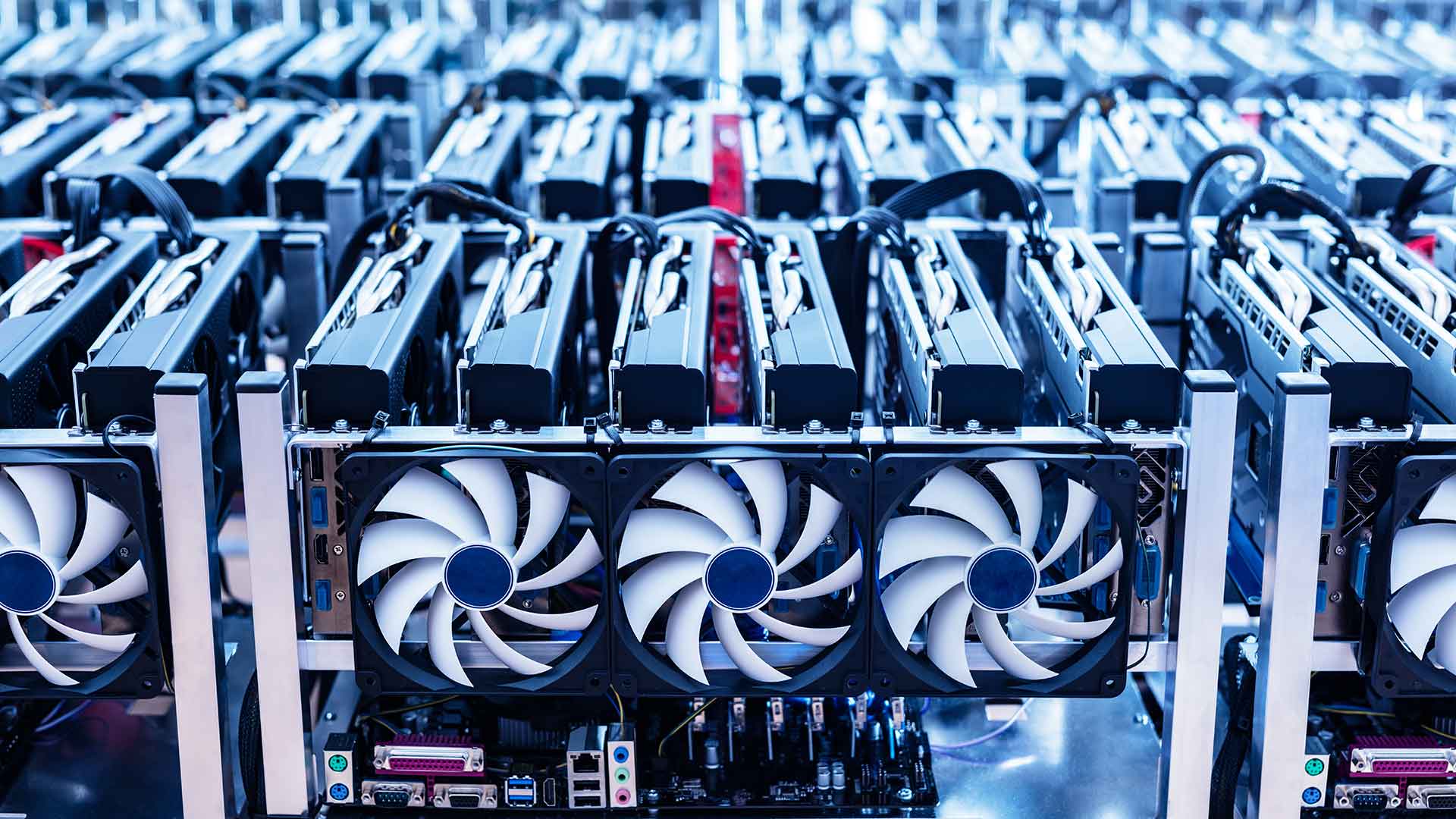

Proof-of-work requires a significant amount of energy to verify transactions. Since computers on the network have to consume a lot of energy, it is less environmentally friendly.

Another problem that some point out is that due to the competition between miners for rewards, the usual grouping into pools and a small number of mining pools control the blockchain, which is a de facto type of centralization. However, it is important to note that mining pools consist of individual miners or smaller groups of miners who are free to use their hashpower if they no longer agree with the direction of the larger mining pool.

The downsides of PoS

The main problem with proof of stake is that it requires an often huge initial investment. You need to buy enough of the native token of that cryptocurrency to qualify as a validator, which depends on the size of the network. In theory, people have to be rich or earn enough money to buy a stake in the network, leading to a blockchain controlled by wealthier individuals. In theory, as the market value of cryptocurrencies grows, this problem could become even more potent.

.jpg)

English (US)

English (US)