What is a stablecoin?

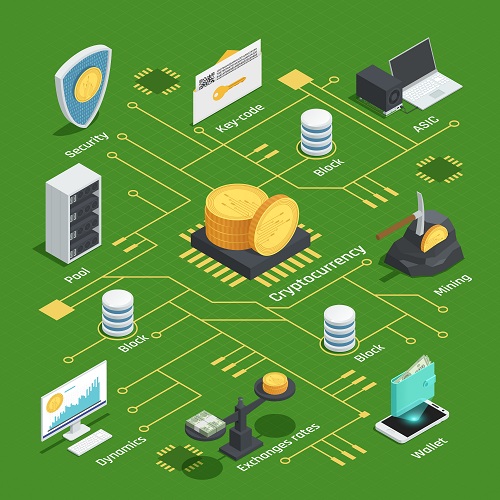

Stablecoins are cryptocurrencies whose value is fixed or linked to that of another currency, commodity or financial instrument. The goal of stablecoins is to provide an alternative to the high volatility of the most popular cryptocurrencies, including bitcoin (BTC), which makes such investments less suitable for widespread use in transactions.

To serve as a medium of exchange, a currency that is not legal tender must remain relatively stable, ensuring that those who accept it retain purchasing power in the short term. Among traditional fiat currencies, daily movements of even 1% in Forex trading are relatively rare. As the name implies, stablecoins aim to solve that problem, promising to keep the cryptocurrency's value stable in a variety of ways. There are three types of stablecoins based on the mechanisms used to stabilize their value.

.jpg)

Fiat-collateralized stablecoins

Fiat-collateralized stablecoins maintain a reserve of fiat currency (or currencies), such as the US dollar, as collateral that secures the value of those stablecoins. Other forms of collateral can include precious metals like gold or silver, as well as commodities like crude oil, but most stablecoins with fiat collateral have US dollar reserves. Such reserves are maintained by independent custodians and are regularly reviewed. Tether (USDT) and TrueUSD (TUSD) are popular stablecoins backed by US dollar reserves and denominated at dollar parity.

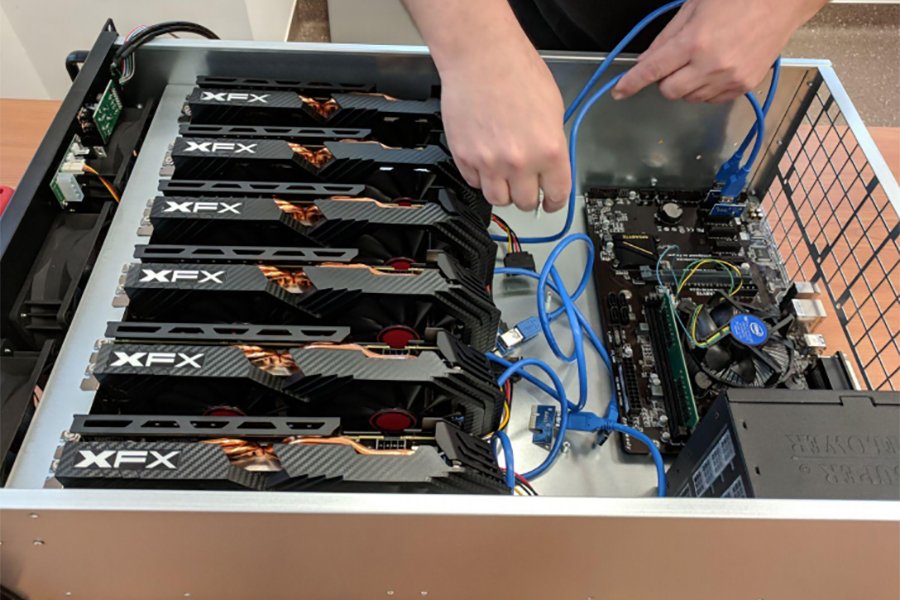

Crypto-collateralized stablecoins

Crypto-collateralized stablecoins are backed by other cryptocurrencies. Since reserve cryptocurrency can also be prone to high volatility, such stablecoins are over-collateralized, that is, the value of cryptocurrency held in reserves exceeds the value of issued stablecoins. Two million dollars worth of cryptocurrency can be held as a reserve for the issuance of one million dollars in a crypto-backed stablecoin, insuring against a 50% drop in the price of the reserve cryptocurrency. For example, MakerDAO's stablecoin Dai (DAI) is pegged to the US dollar, but is backed by Ethereum (ETH) and other cryptocurrencies worth 150% of the DAI stablecoin in circulation.

Algorithmic stablecoins

Algorithmic stablecoins may or may not contain reserve funds. Their primary difference is the strategy of keeping the stablecoin's value stable by controlling its supply with an algorithm, essentially a computer program that runs a preset formula. In some ways this is not so different from central banks, which also do not rely on reserve funds to keep the value of the currency they issue stable. The difference is that a central bank like the Federal Reserve publicly sets monetary policy based on well-understood parameters, and its legal tender status does wonders for the credibility of that policy. Issuers of algorithmic stablecoins cannot rely on such advantages in a crisis. The price of the algorithmic stablecoin TerraUSD (UST) fell more than 60% on May 11, 2022, almost completely eliminating its link to the US dollar as the price of the related Luna token used to peg Terra fell by more than 80% overnight.

.jpg)

English (US)

English (US)