What is Bitcoin Mining?

Bitcoin "mining" is the process by which new bitcoins are put into circulation. It is also how the network validates new transactions and is a critical component of maintaining and developing the blockchain ledger. Mining is performed using sophisticated hardware that solves an extremely complex computational mathematical problem. The first computer to find a solution to the problem gets the next block of bitcoins and the process starts over.

Bitcoin mining

Cryptocurrency mining is painstaking, expensive and only sporadically profitable. Despite this, mining has a magnetic attraction for many investors who are interested in cryptocurrencies due to the fact that miners are rewarded for their work with crypto tokens. That may be because entrepreneurial types see mining as a coin from heaven, like the California gold prospectors of 1849. And if you're tech-savvy, why not give it a go? The bitcoin reward that miners receive is an incentive that motivates people to help with the primary purpose of mining: to legitimize and monitor bitcoin transactions, ensuring their validity. Because many users around the world share such responsibilities, bitcoin is a "decentralized" cryptocurrency, or one that does not rely on any central body such as a central bank or government to oversee its regulation.

Why does Bitcoin need miners?

Blockchain mining is a metaphor for the computational work that nodes in a network undertake in the hope of earning new tokens. In reality, miners are actually paid for their work as auditors. They do the work of verifying the legitimacy of bitcoin transactions. That convention aims to keep bitcoin users honest and was designed by Bitcoin's founder, Satoshi Nakamoto. By verifying transactions, miners help prevent the "double spend problem".

Double spending is a scenario where a bitcoin owner illegally spends the same bitcoin twice. With physical currency, this is not a problem: when you buy a bottle of vodka with 20 euros, you no longer have it, so there is no danger that you could use that same note to buy a lottery ticket. While counterfeiting cash is possible, it's not quite the same as spending the same dollar twice. With digital currency, there is a risk that the holder could make a copy of the digital token and send it to another party, keeping the original. Let's say you have one 20-euro bill and one identical counterfeit. If you were to try to spend both a real and a fake bill, someone who bothered to look at the serial numbers of both bills would see that they were the same number, so one would have to be fake. What a blockchain miner does is analogous to that as miners verify transactions to ensure that users have not illegitimately tried to spend the same bitcoin twice.

Why mine bitcoins?

Apart from lining the pockets of miners and supporting the Bitcoin ecosystem, mining serves another vital purpose as it is the only way to get the new cryptocurrency into circulation. In other words, miners basically “mint” the currency. Except for coins minted with the genesis block (the first block created by founder Satoshi Nakamoto), every bitcoin was created thanks to miners. In the absence of miners, Bitcoin as a network would still exist and be usable, but there would never be any additional bitcoins. However, since the rate of bitcoin mined decreases over time, the final bitcoin will not be in circulation until around 2140. This does not mean that transactions will stop being verified. Miners will continue to verify transactions and will be paid fees for doing so in order to maintain the integrity of the Bitcoin network.

Bitcoin mining rewards are cut in half approximately every four years. When bitcoin was first mined in 2009, mining one block would yield 50 BTC. In 2012 it was halved to 25 BTC. By 2016, this was halved again to 12.5 BTC, while on May 11, 2020, the reward was halved again to 6.25 BTC. Interestingly, the market price of bitcoin has historically been closely aligned with the decline of new coins entering circulation. That lower inflation rate would increase the shortage and the price would rise with it.

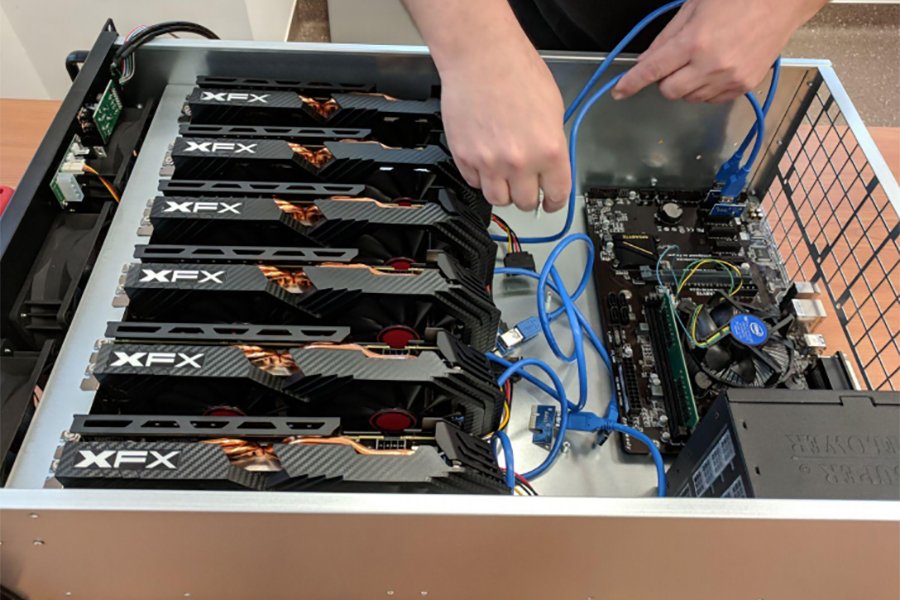

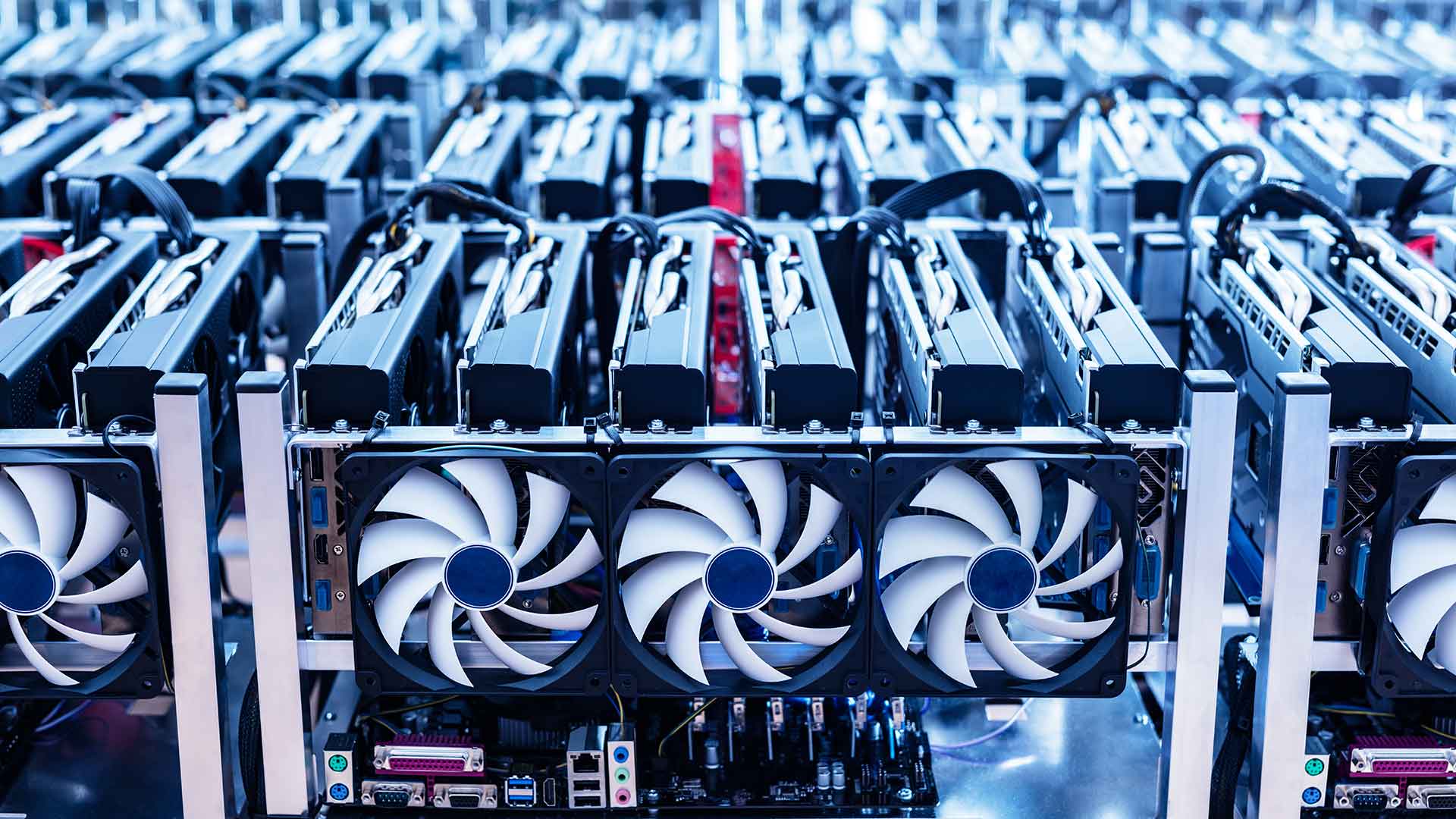

Although early in Bitcoin's history individuals could compete for blocks with ordinary personal computers at home, this is no longer the case. The reason for this is that the difficulty of mining bitcoins changes over time. All this means that, in order to mine competitively, miners must now invest in powerful computing equipment such as a graphics processing unit (GPU) or, more realistically, an application-specific integrated circuit (ASIC), which can range from 500 euros to several tens of thousands of euros. . Therefore, some miners, especially ether miners, buy individual graphics cards as a cheap way of a makeshift mining operation.

.jpg)

English (US)

English (US)